Six-axis robot: servo motor, the core component of industrial robots. Industrial robots can be divided into six-axis robots, SCARA robots, Delta robots and collaborative robots.

Six-axis robot: servo motor, the core component of industrial robots

According to IFR data, global industrial robot sales reached $21.7 billion in 2022 and are expected to reach 23 billion yuan in 2024, of which China’s industrial robot sales account for more than 50% of the world. At the same time, with the expansion of the scope of operation activities, the emergence of consumption upgrade needs, and the evolution of AI large models and computing power, it is expected to accelerate the application of industrial robots in various scenarios.

High-end servo motor products

Six-axis robots can be further divided into large six axes (> 20KG) and small six axes (≤ 20KG) according to the size of the load.

From the compound growth rate of sales in the past five years, the large six-axis (48.5%)> collaborative robot (39.8%)> small six-axis (19.3%)> SCARA robot (15.4%), >Delta robots (8%).

In 2017~2022, the shipment volume of six-axis robots will increase from 104095 units to 188238 units, with a compound growth rate of 12.6%, and it is expected that 214732 units will be shipped in 2023, with a year-on-year growth rate of 14.1%.

Among them, large six-axis robots are the largest category, with a compound growth rate of 12.6% in sales of six-axis robots in 2017~2022, 188,000 units shipped in 2022, and ultra-small six-axis growth rate, which is the main contribution category to the sales growth of six-axis robots.

Robot arm simulation action test – robot module video

Although six-axis robots are the most widely used category in China, six-axis robots, especially large six-axis robots, have high technical barriers and low localization rate. In recent years, the growth of six-axis sales has been mainly driven by the new energy and auto parts industries, and there is broad space for domestic substitution.

Main categories of industrial robots:

1. Joint robot: its mechanical structure is similar to a human arm.

2. Cartesian coordinate robot: This robot has three straight joints and adopts Cartesian coordinate system.

3. Multi-joint robot: This robot has six degrees of freedom and is currently the most commonly used industrial robot.

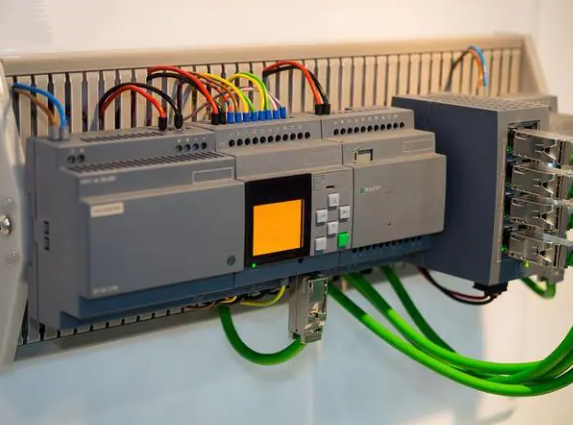

Programmable logic controller

4. Parallel robot: This robot is composed of parallel joint connecting rods connected to the common base.

5. Polar robot: This robot operates in a polar coordinate system by combining a rotating joint, two rotating joints and a straight joint.

Six-axis robot industry overview

A multi-joint robot generally refers to a joint robotic arm with 6 axes of rotation.

The advantage is that similar to the human hand, it has a high degree of freedom, suitable for almost any trajectory or angle of work.

With different end effectors, the multi-joint robot can be applied to loading, unloading, painting, surface treatment, testing, measurement, arc welding, spot welding, packaging, assembly, chip machine tools, fixation, special assembly operations, forging, casting and a large number of application scenarios.

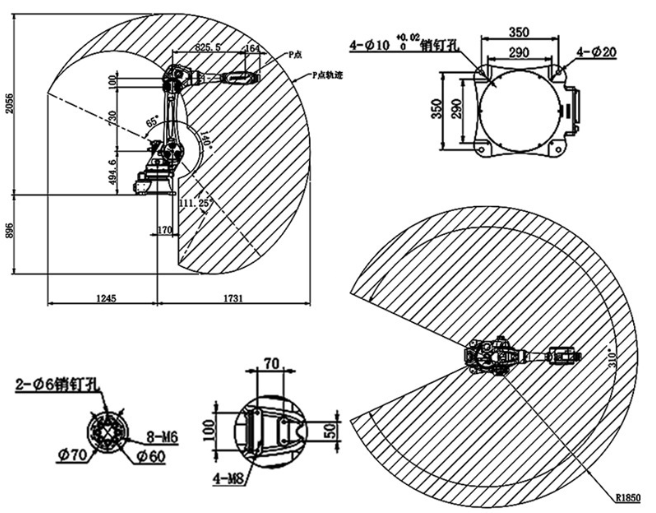

Illustration of a six-axis robot:

Illustration of a six-axis robot – Six-axis robot: servo motor, the core component of industrial robots

China’s industrial robot body presents the characteristics of “insufficient high-end production capacity and low-end overcapacity”.

While the production and sales of industrial robots are growing rapidly, many industrial robot manufacturing enterprises are mainly assembled and OEM processing, and are at the low end of the industrial chain, and the strong low-end market demand has brought signs of overheating in the industry.

The short-term profit-seeking of capital and the long-term development law of the industrial robot industry contradict each other, making the high-end ontology such as domestic industrial robots with more than six axes insufficient, while the overcapacity of low-end ontology (Cartesian coordinate robots based on handling and loading and unloading) is serious.

According to the statistics of the Ministry of Industry and Information Technology, China’s own brand industrial robots are mainly three-axis and four-axis coordinate robots and flat multi-joint robots, and six-axis jointed robots account for less than 6% of the national industrial robot sales.

Among the industrial robots sold by foreign brands, jointed robots account for 62% of the national industrial robot sales, and the independent brand products are far from meeting the development requirements of various fields of the national economy.

Schematic diagram of the six-axis articulated robot transmission system structure:

Six-axis robot market pattern

China’s high-power six-axis robot market is basically monopolized by the “four major families” Fanuc, ABB, Yaskawa and Kuka.

The “four major families” business basically opens up the whole industrial chain, except for the reducer market is basically monopolized by Japanese companies Nabtesco and Harmonic, the business scope of international leading enterprises basically covers the upstream, middle and downstream of the industrial chain.

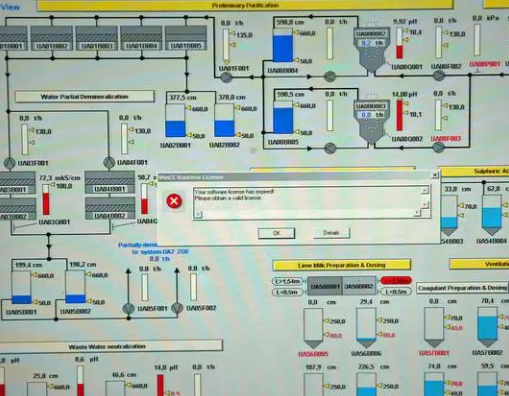

Programmable Logic Controller – Servo motor control scheme

In 2022, the localization rate of China’s industrial robots will be only 35%, of which the sales volume of Fanuc/ABB/Yaskawa/KUKA in China will be 4.3/2.3/2.3/22,000 units, respectively, with a market share of 15.3%/8.2%/8.2%/7.9%, accounting for a total of 40%. In the same period, the market share of China’s leading industrial robot Eston / Huichuan technology robot sales was only 5.9%/5.2%.

With its ultimate mastery of the underlying CNC system technology, the global industrial robot dragon Nako firmly holds its position as the global industrial robot leader, and the gross profit margin level is higher than that of Yaskawa Electric and ABB, which are also four families of industrial robots.

Drawing of a six-axis industrial robot manipulator – Six-axis industrial robot manipulator with servo motor

Domestic industrial robots have the advantages of local industrial chain, and in recent years, they have gradually ushered in an important window period of import substitution. According to MIR data, in 2022Q3, the domestic output of six-axis robots increased month-on-month, and the shipments of the four major families in China showed a downward trend.

Six-axis industrial robot manipulator 1820 handling welding palletizing spraying manipulator

In the large six-axis link with low localization rate and high barriers, domestic head manufacturers are represented by Eston, Huichuan Technology, EFORT, Xinshida, etc., and have a certain scale and technical strength.

Illustration of the whole industry chain of industrial robots and some representative manufacturers:

On the whole, the hardware technology of the robot body has matured, mainly in the optimization of structure and the improvement of user experience; The advantages of foreign giants are gradually transferred to software, giving domestic ontology a window to catch up. Mastering independent operation control technology and improving added value is a development trend that continues to be verified, and China is still in a period of growth, and leading manufacturers are expected to lead domestic substitution.

From the perspective of downstream demand, with the high demand for new energy vehicles, lithium batteries, photovoltaic and other industries, the demand for high-power 6-axis robots (>20kg) has increased.